Branchless Banking

Core Banking Solution

Next Generation Banking

As-a-Service | Cloud | On-premise

Our Solution

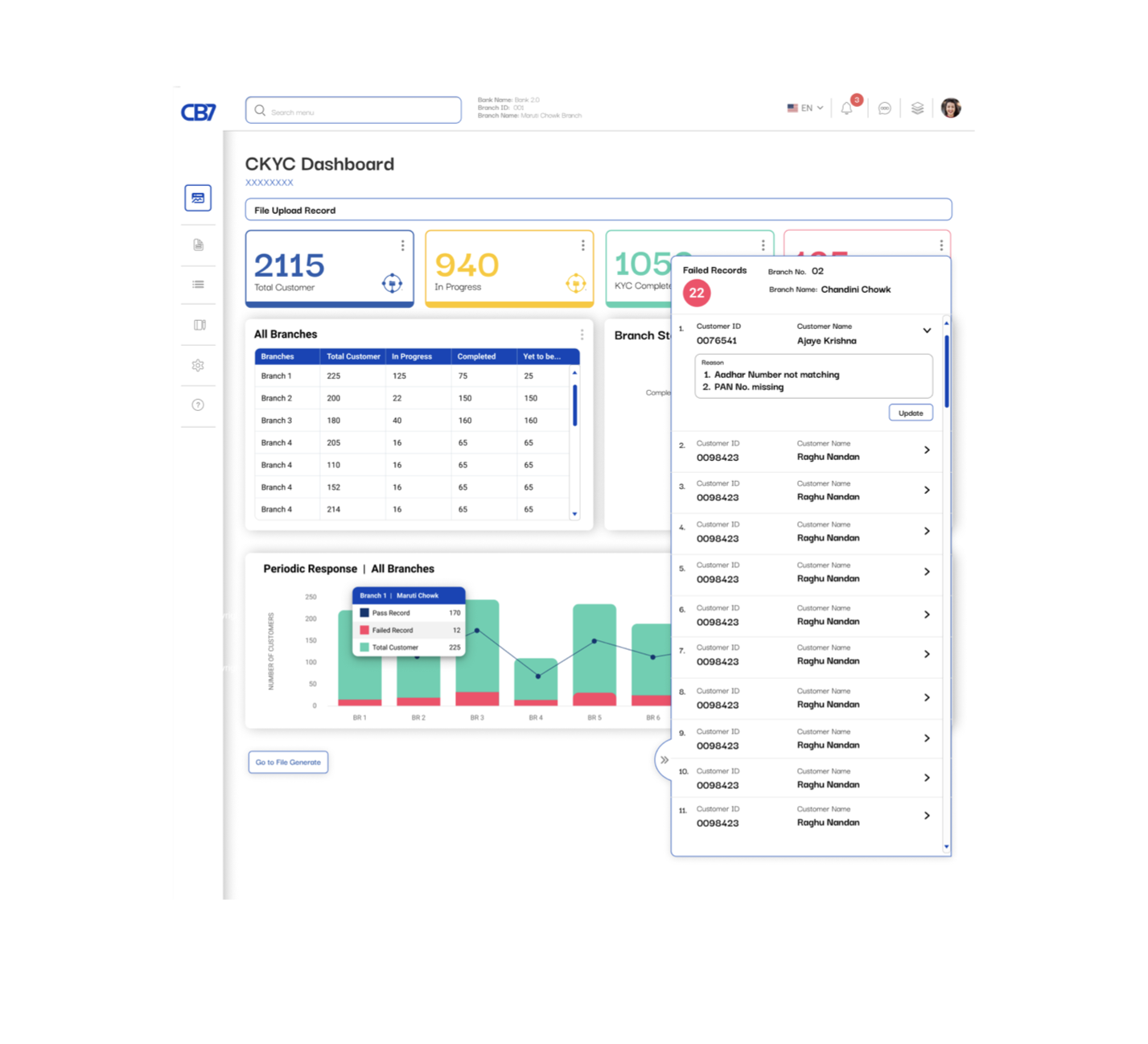

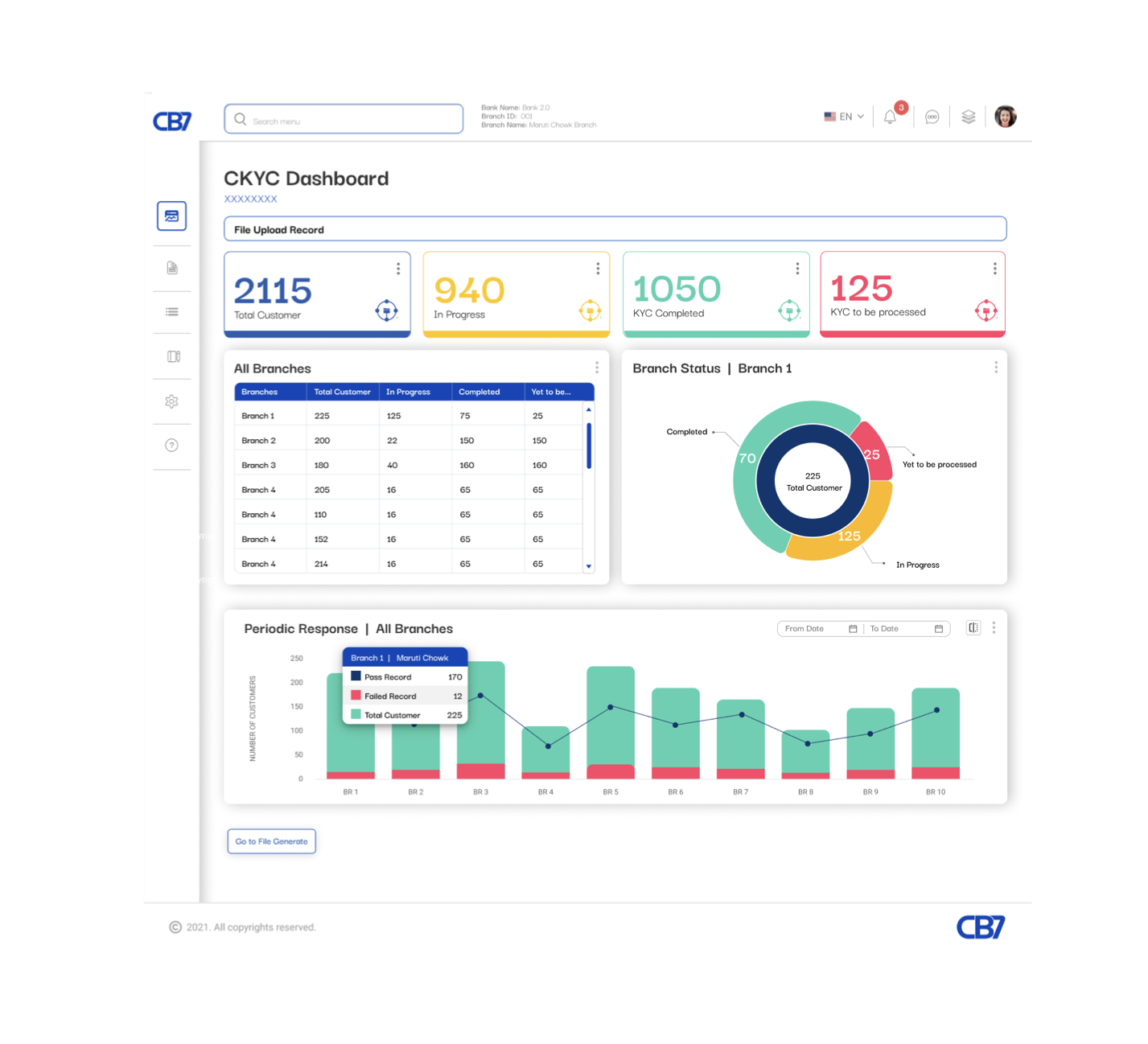

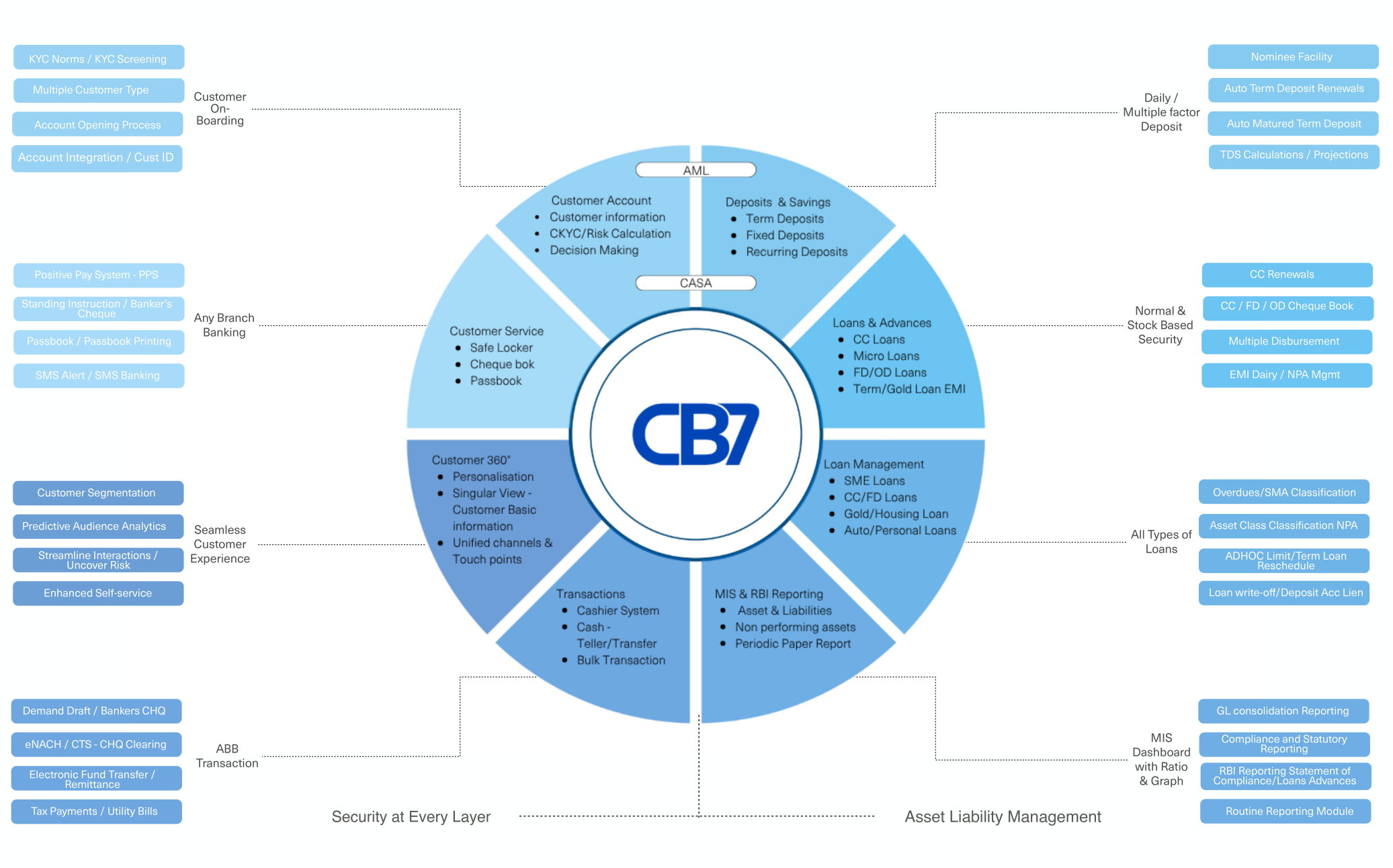

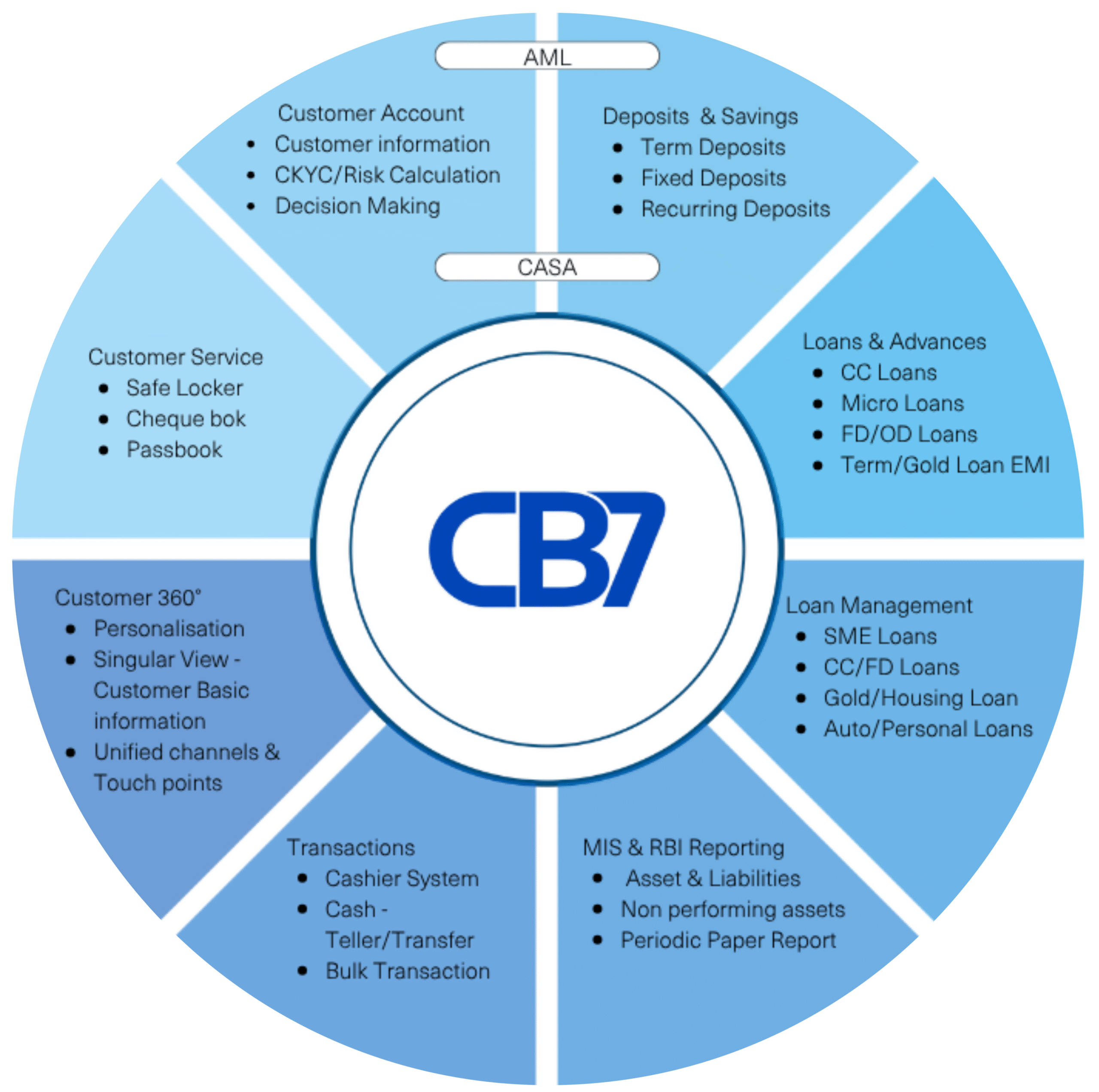

Our CB7 Core Banking solution helps your financial institution improve the client experience, automate and optimise procedures, simplify banking operations for your employees, improve risk management, increase productivity, and ensure full regulatory compliance.

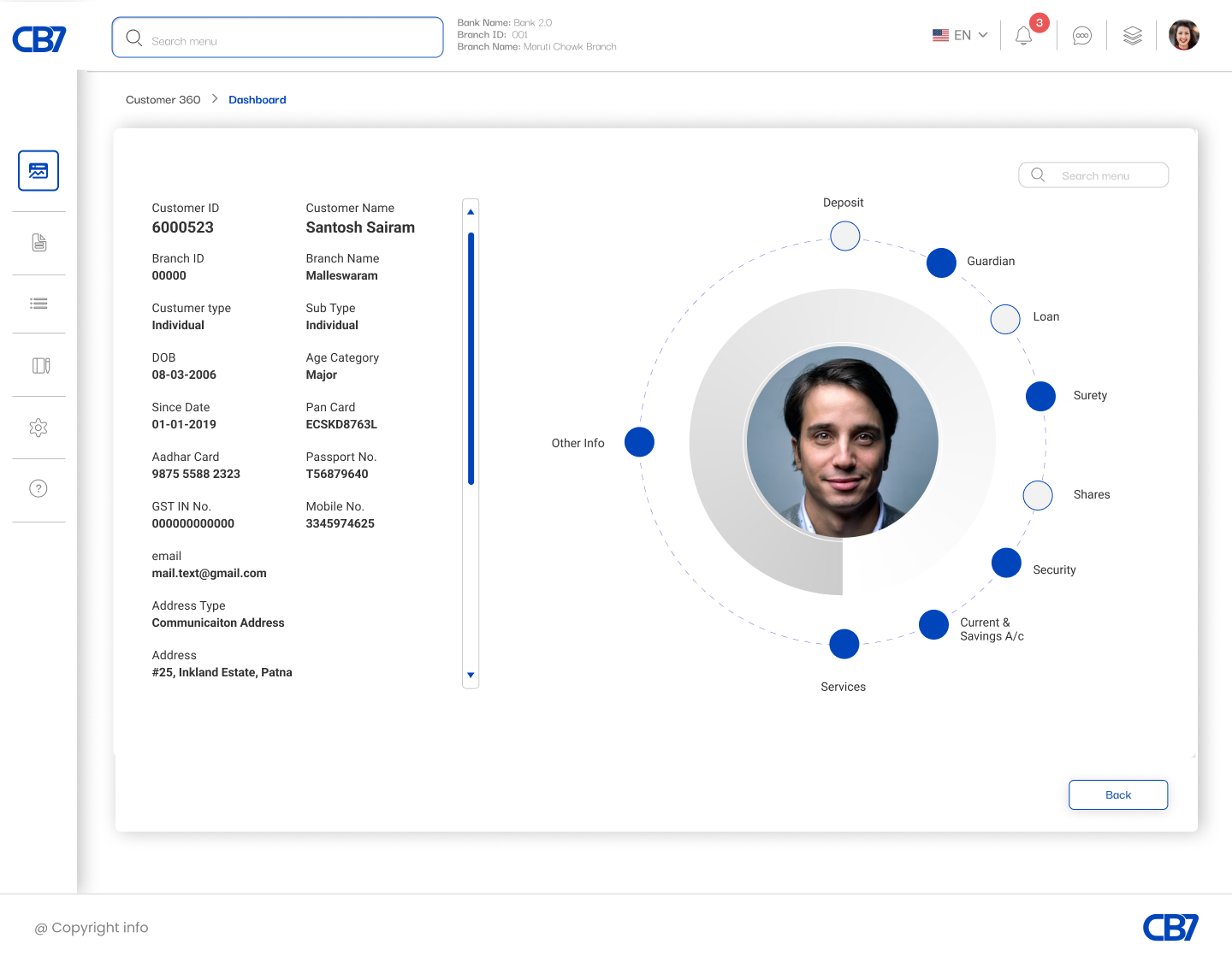

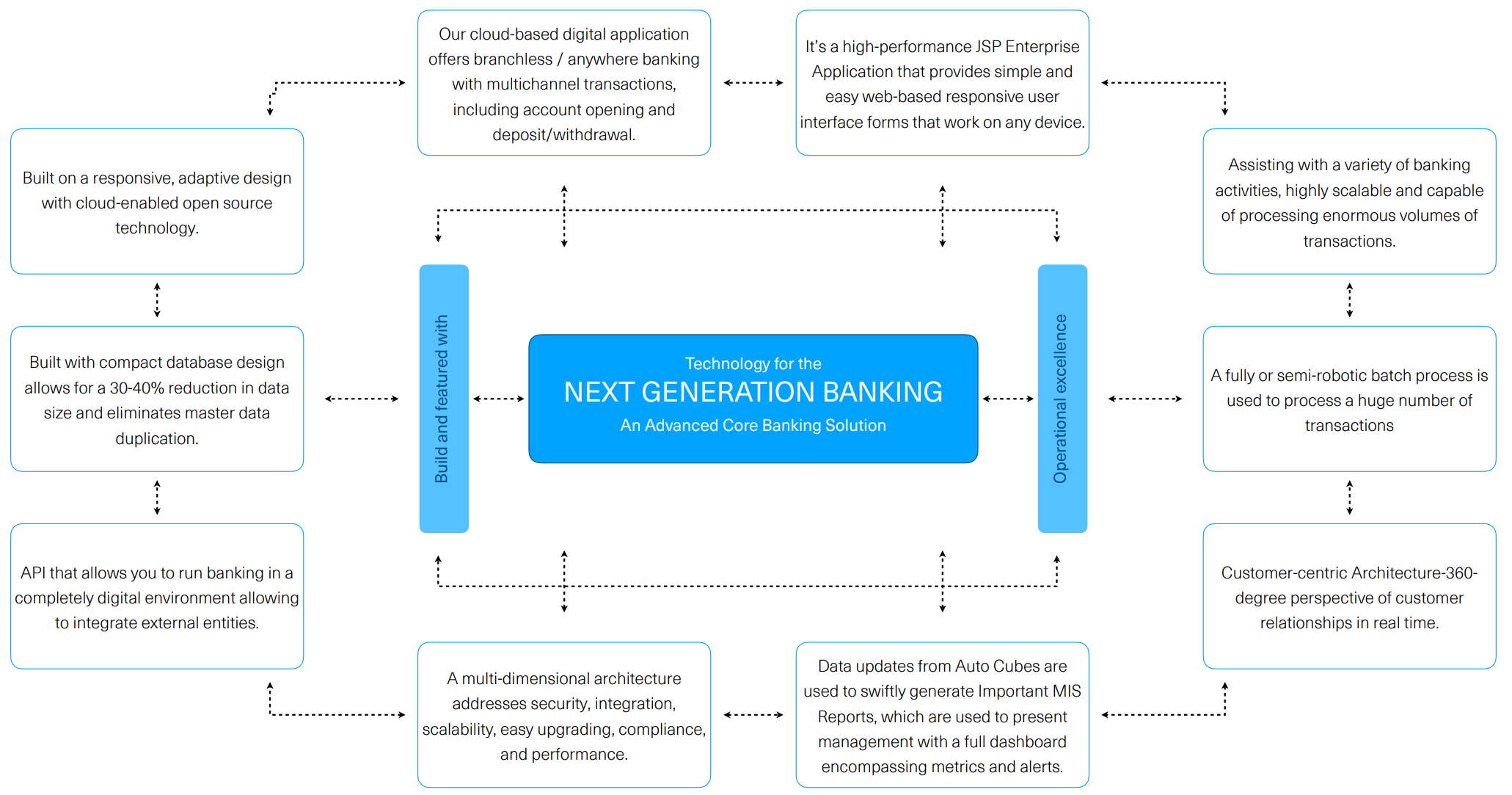

The open-source cloud technology used to build the CB7 applications is adaptive and curated, with a responsive and flexible design. One of the key drivers for the software is a 360-degree client-centric approach, which enables AI-driven models for cross-sell opportunities as well as improved risk management practises.

User Management

1. User role based modules customisation / management.

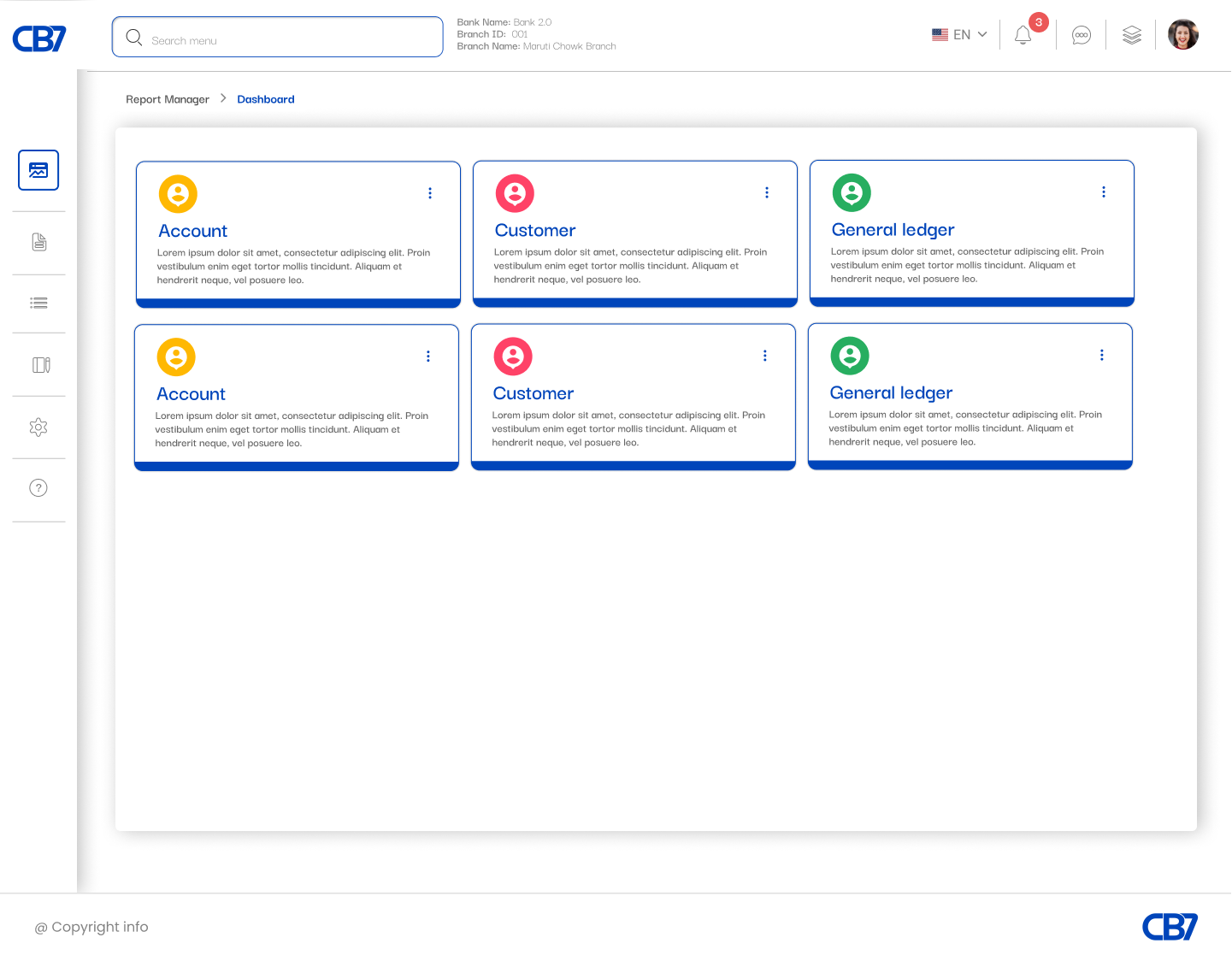

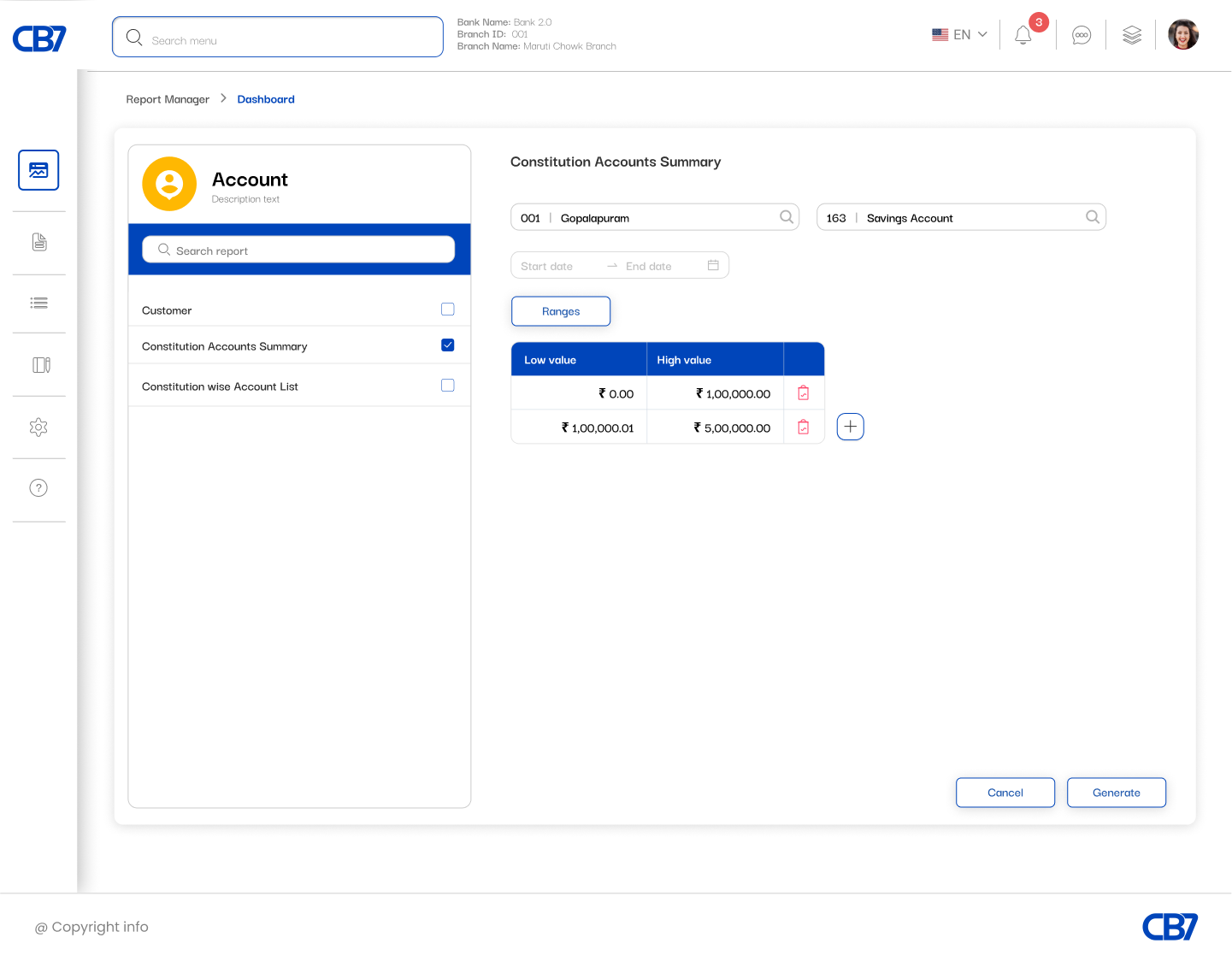

2. User role based interactive customised reports.

Sign-in/Authentication

1. Single sign-on multiple products.

2. Two factor authentications.

Alerts & Automation

1. Automated day-begin and day-end based on scheduler.

2. Automated interest application / charge application based on scheduler.

3. Auto SMS and alerts management.

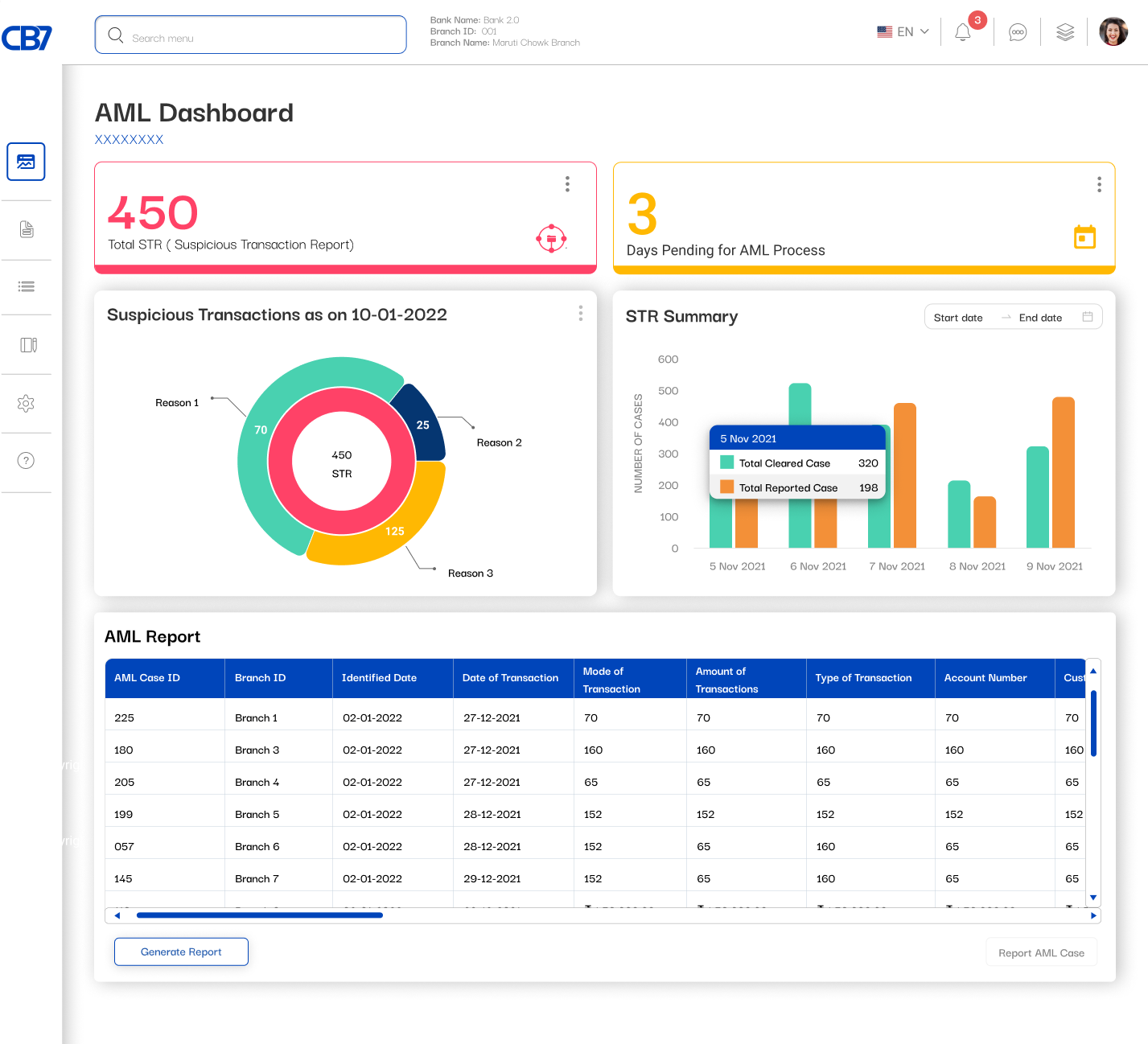

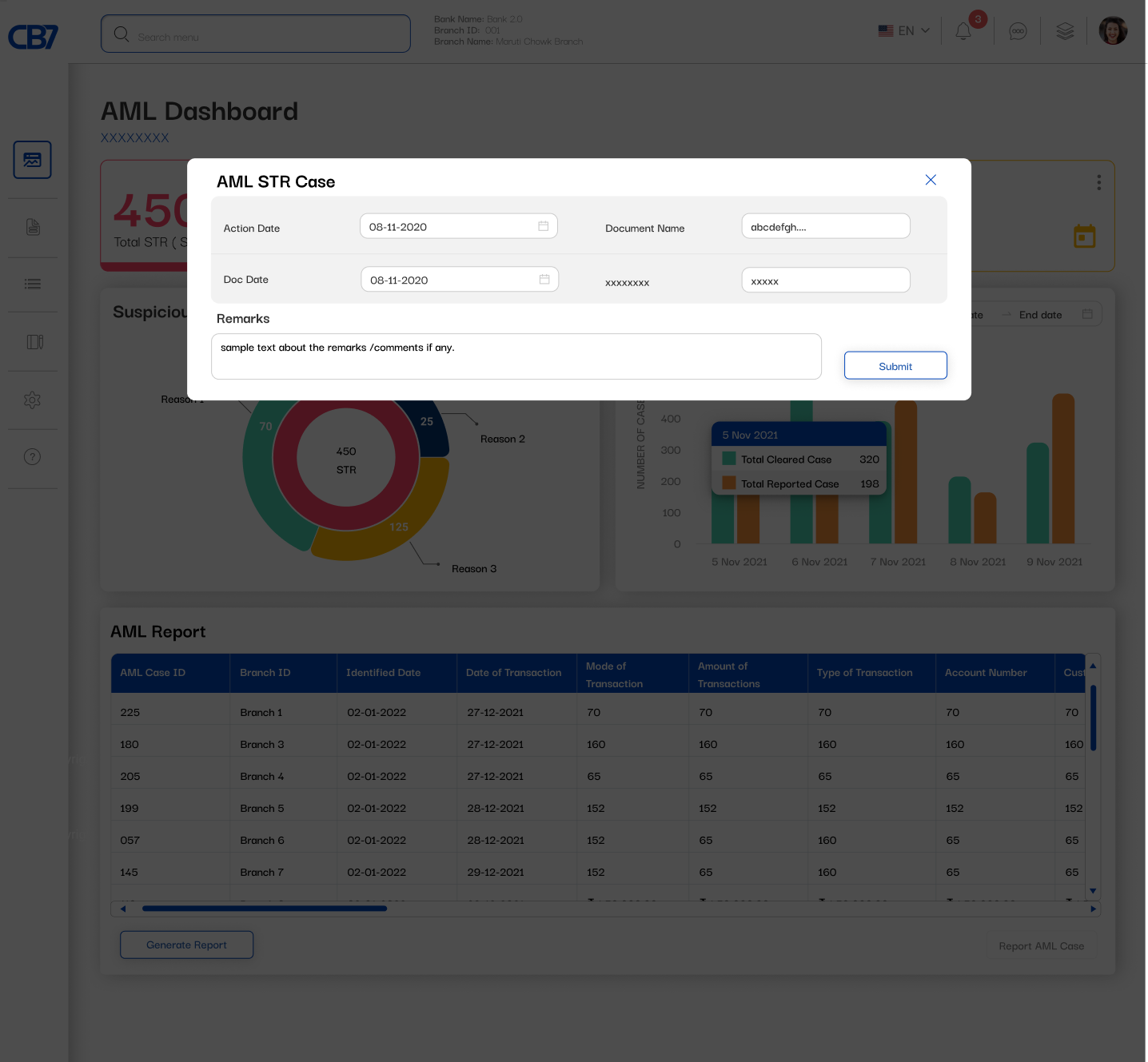

Credit & Compliances

1. Credit bureau process.

2. Anti money laundering.

Core Banking Solution

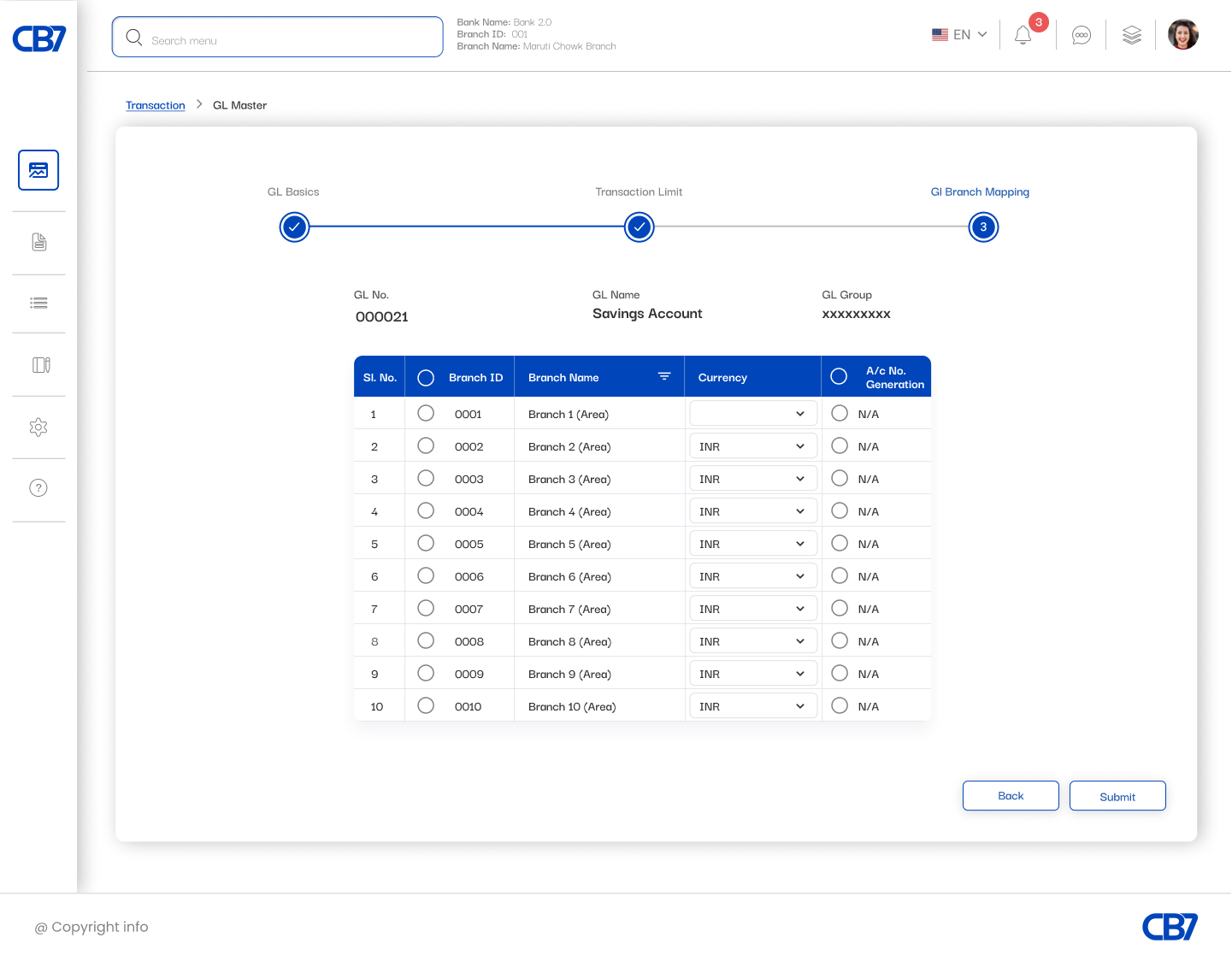

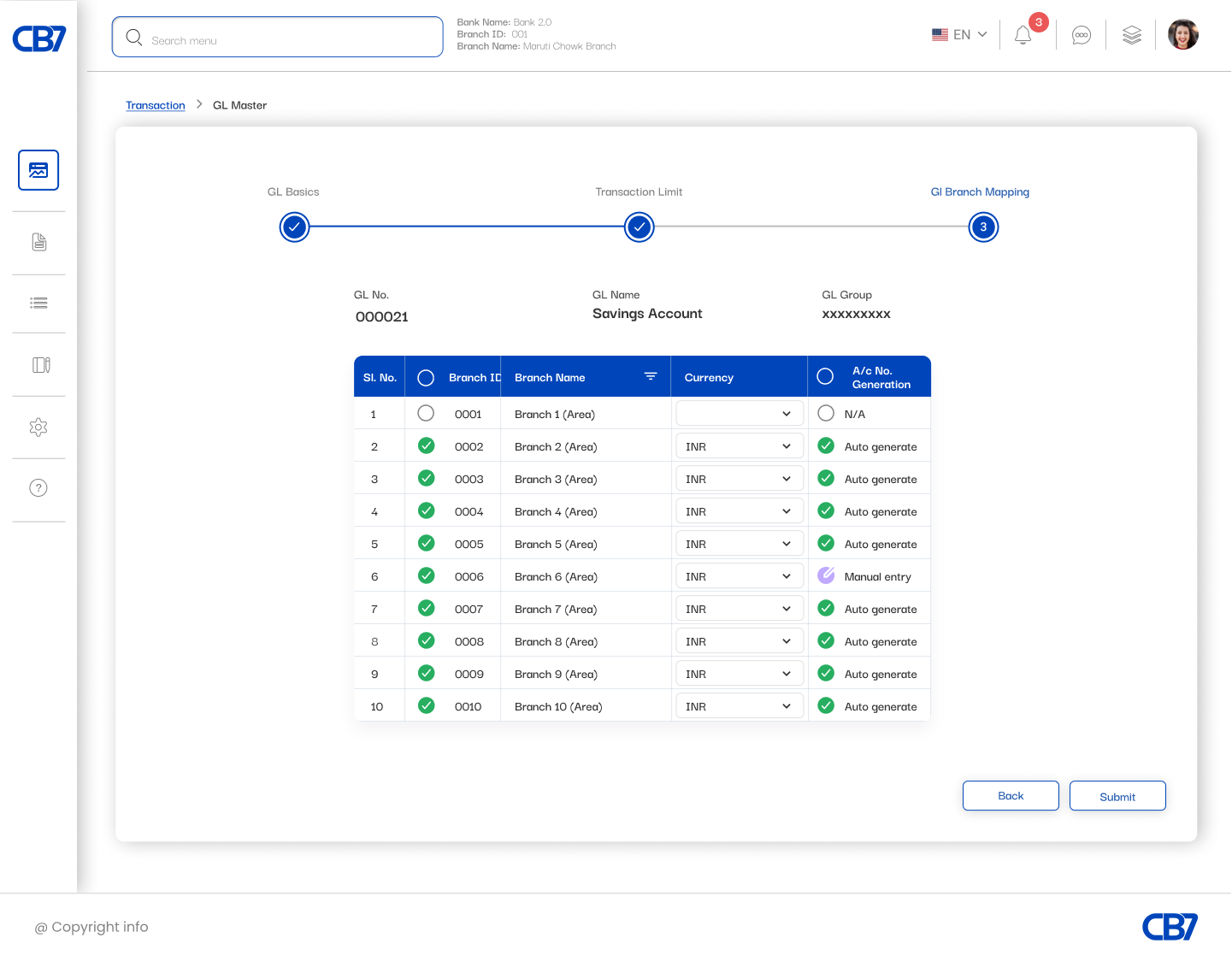

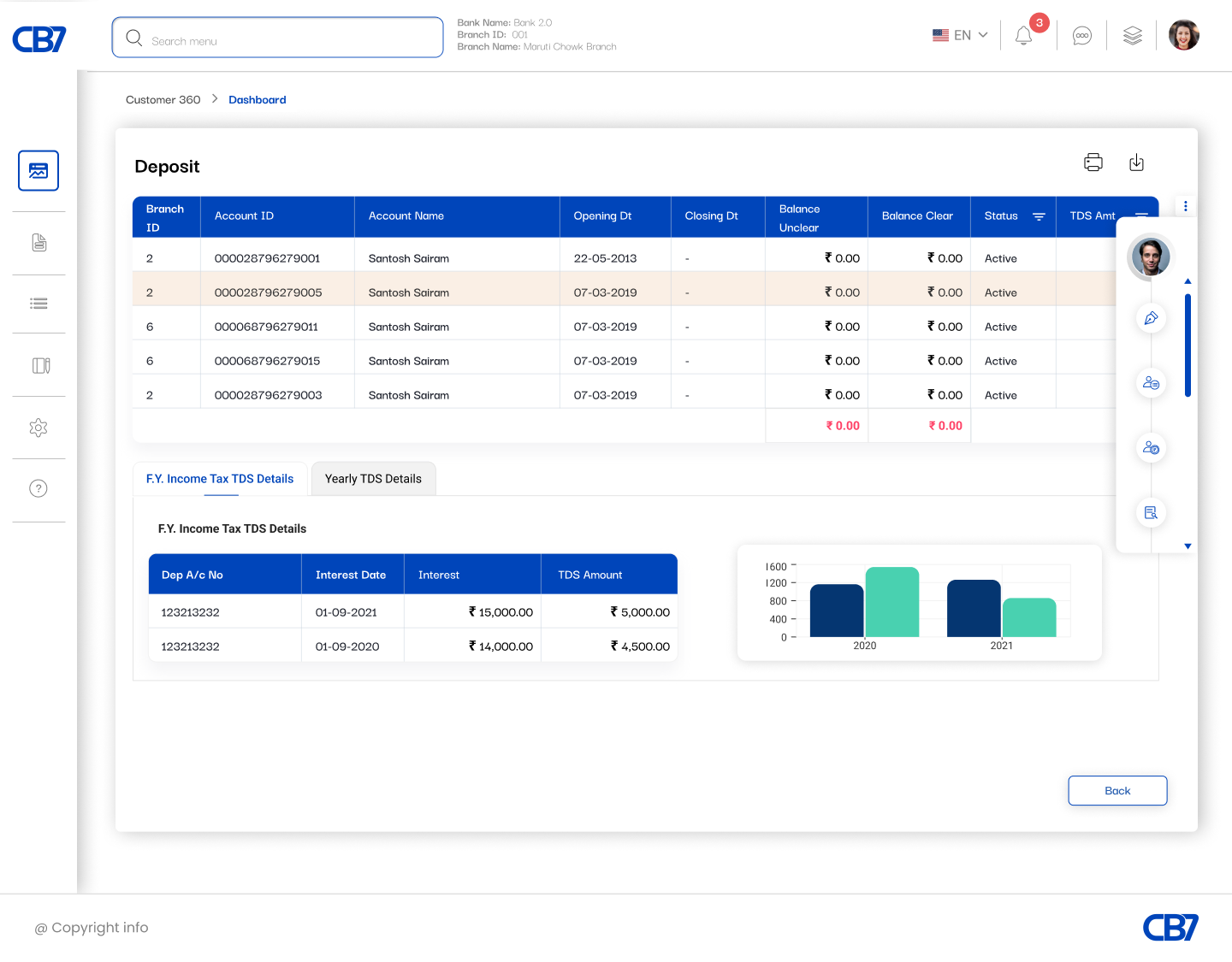

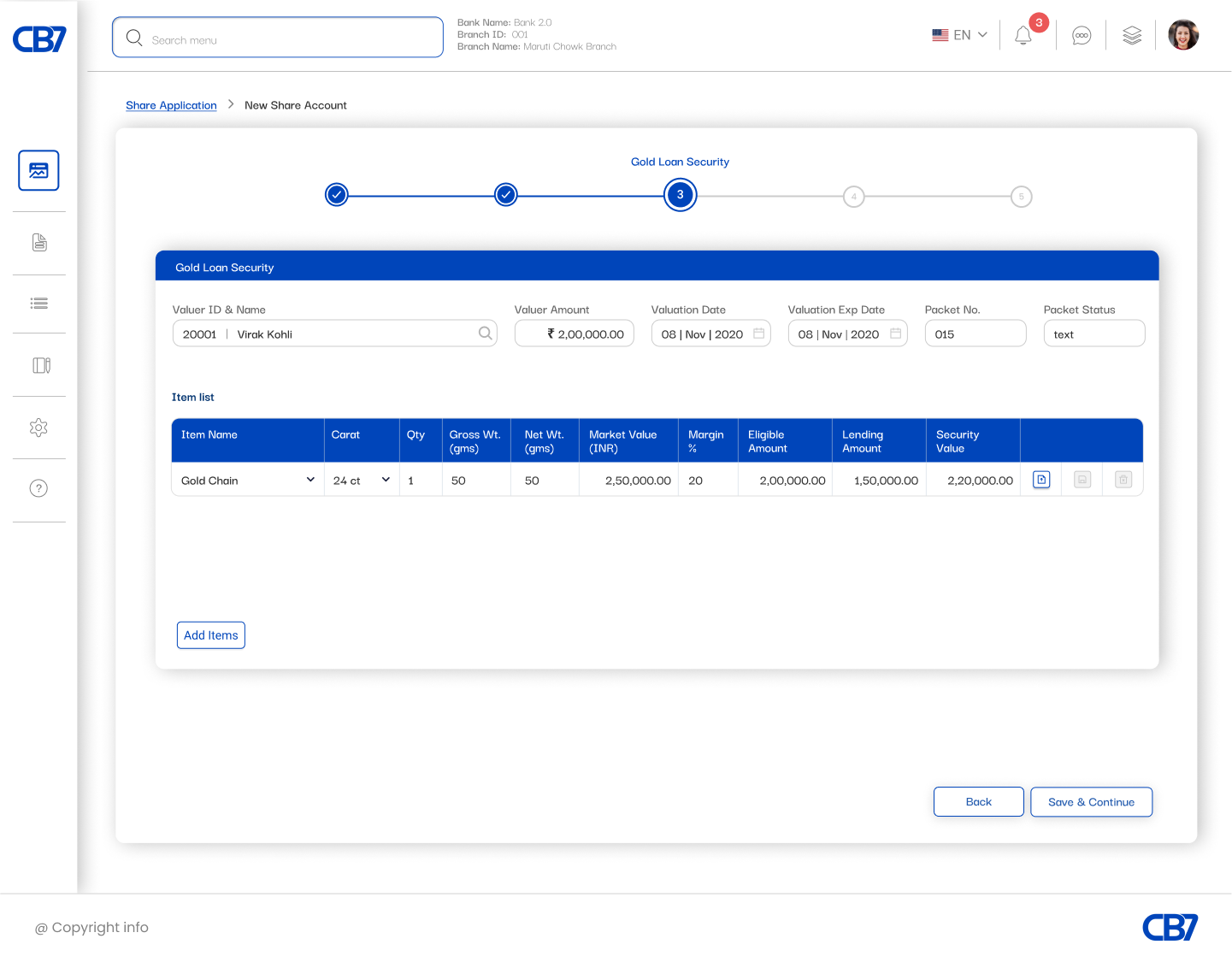

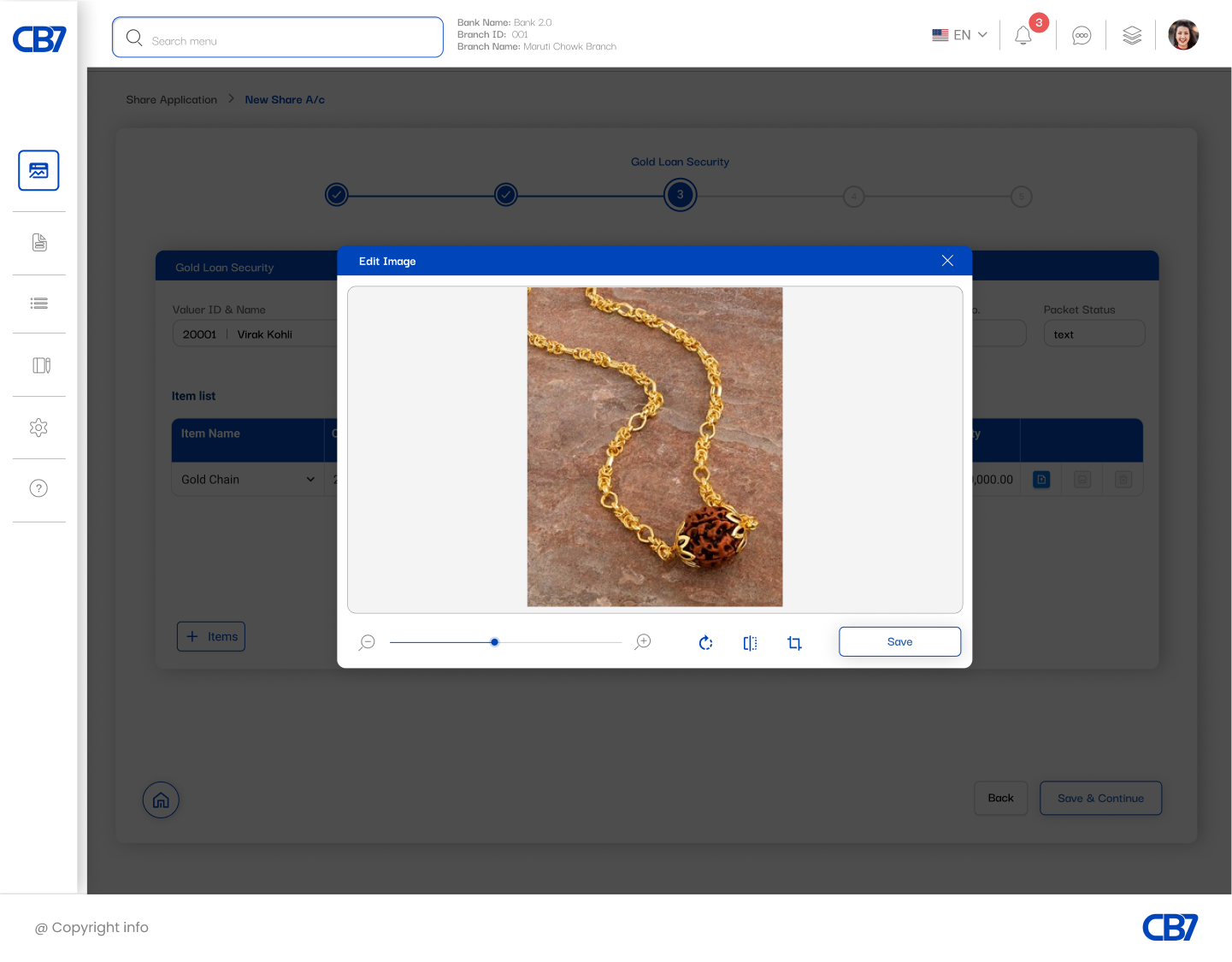

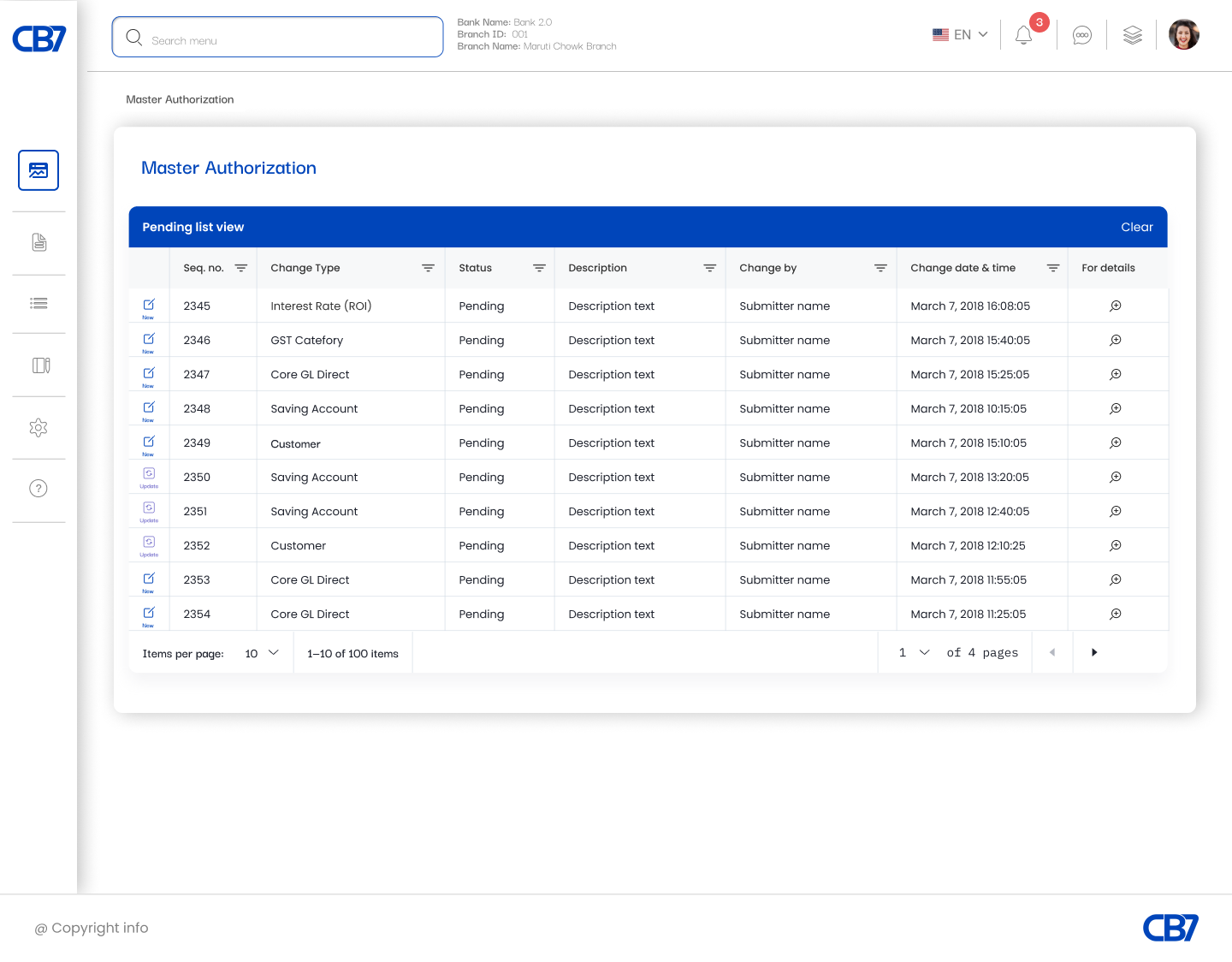

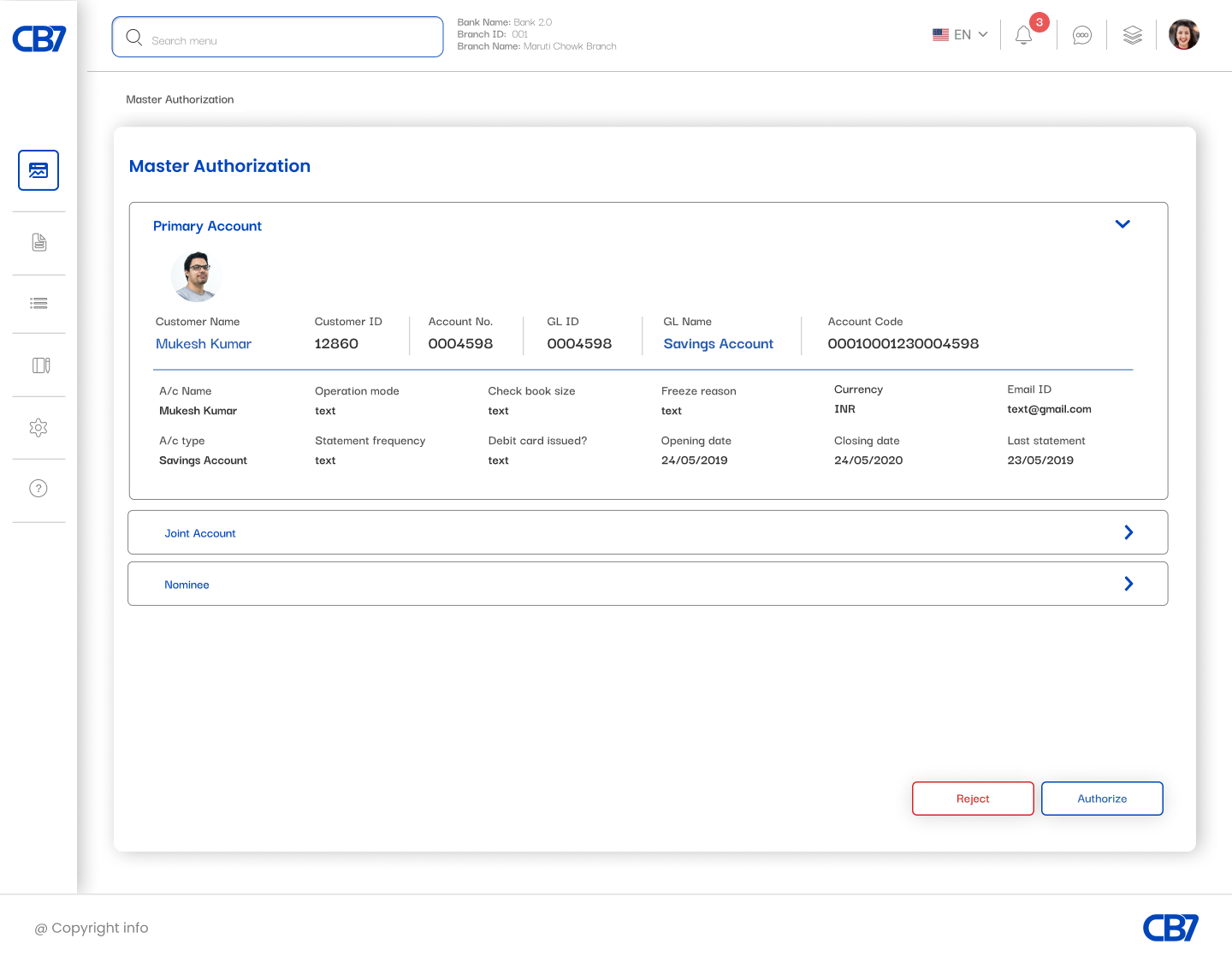

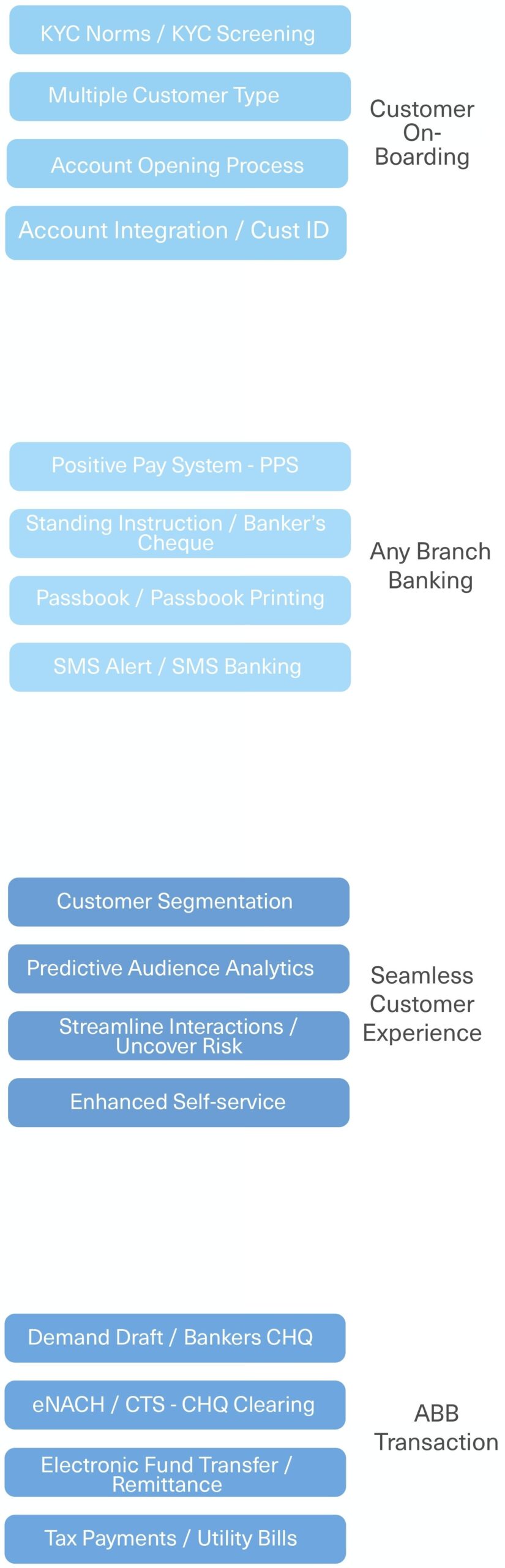

CB7 offers a comprehensive, agile core banking solution designed for seamless digital banking. From customer onboarding and loan disbursal to deposits, withdrawals, and transaction processing, CB7 ensures real-time, end-to-end banking operations. The platform supports a wide range of services including interest calculation, payments (cash, cheques, NEFT, RTGS), and CRM activities — all accessible through a secure, customizable interface.

With a customer-centric architecture and 360° relationship insights, CB7 enables banks to configure products, manage accounts, set dynamic rules (e.g., minimum balances, interest rates), and reduce operational costs through automation and analytics. Fully extensible via parameters and user-driven customization, CB7 empowers financial institutions to adapt and scale quickly in a digital-first economy.

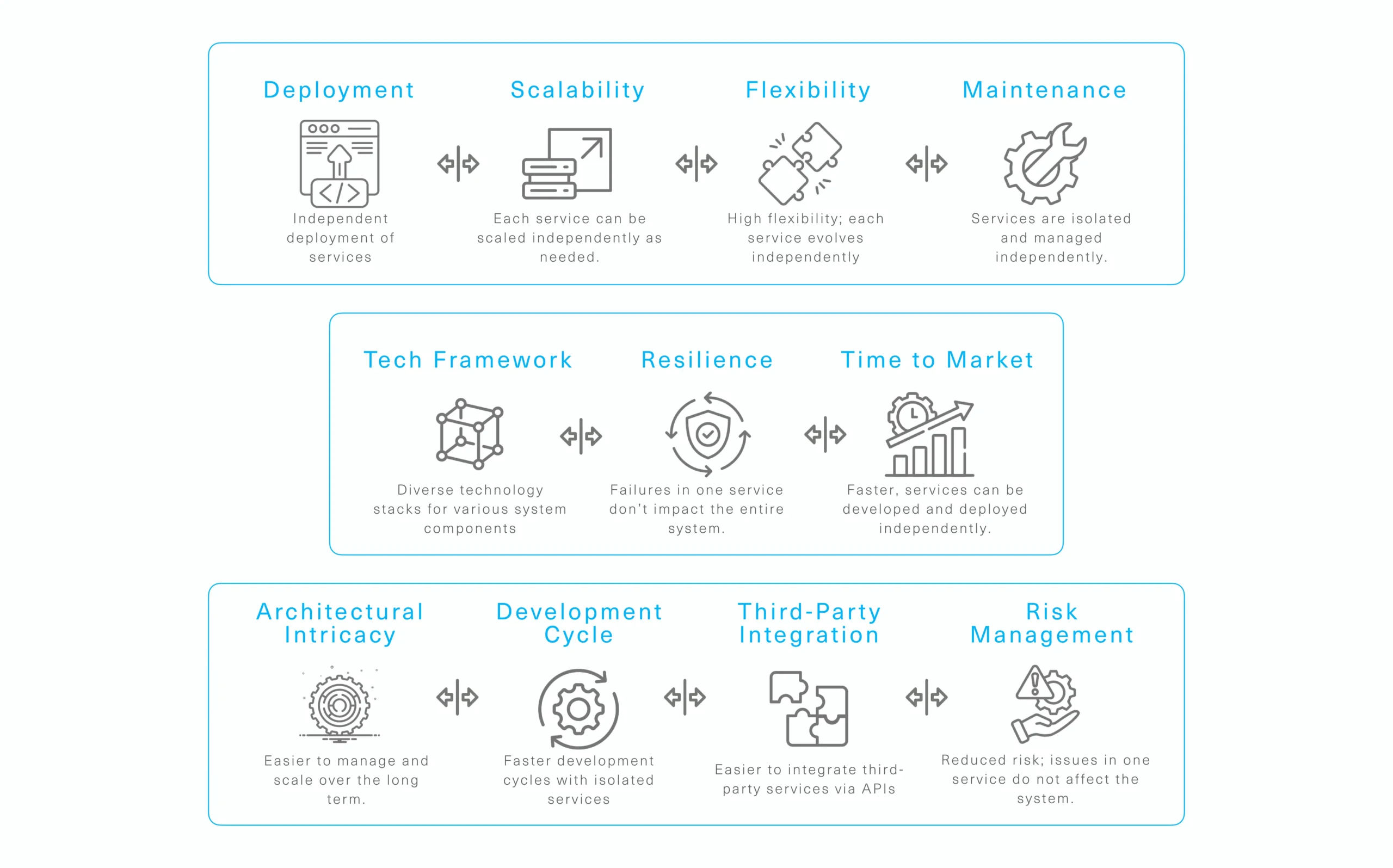

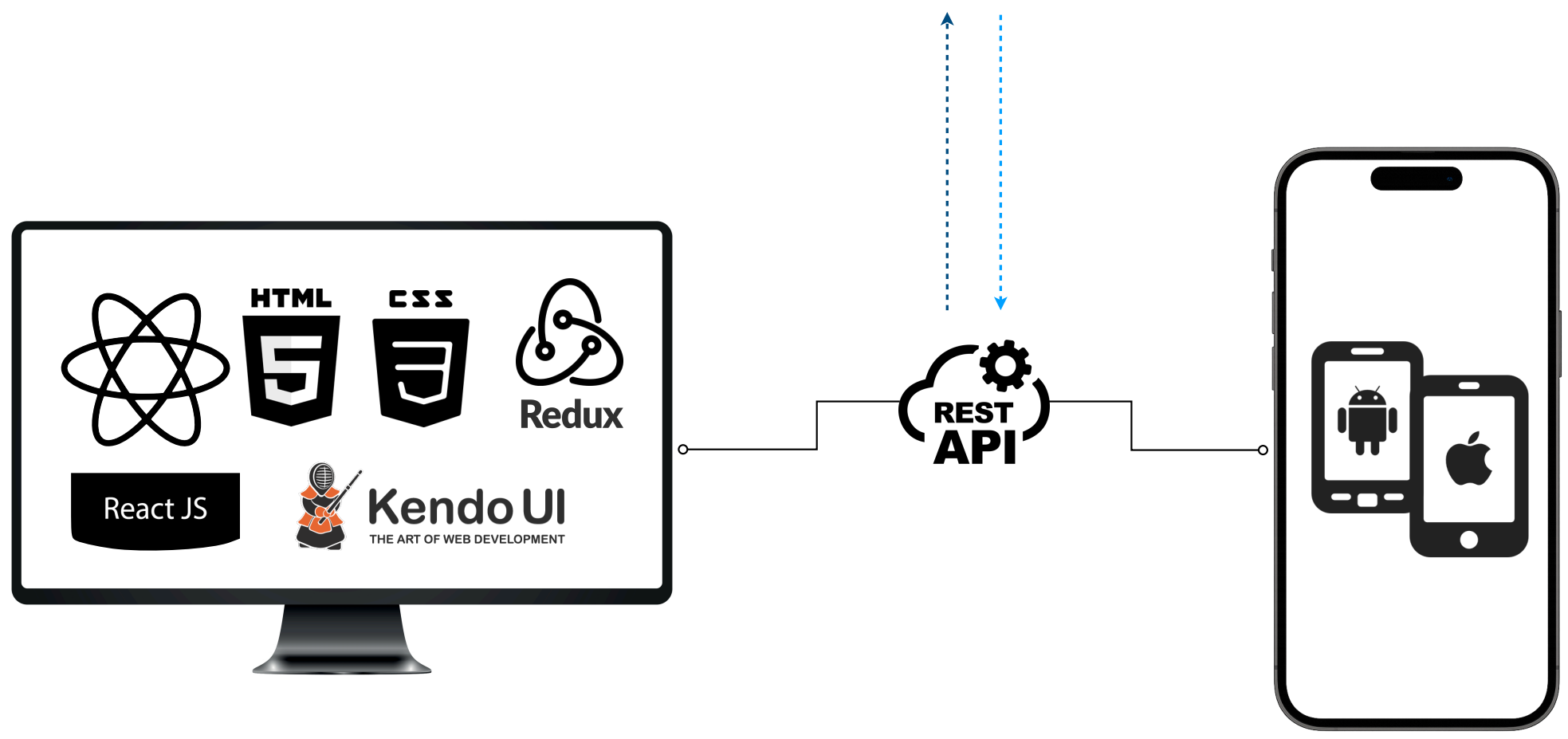

Technology Stack & Digital Transformations

Core

Application

The front end is a client-side, this is the part of an app with which users interact directly. Our front-end is a combination of HTML, CSS, and JavaScript. HTML allows you to structure page elements, CSS is used to style the look and feel of a document created using HTML and JavaScript allows you to add dynamics to the user interface. To speed up the process our framework helps to create an effective application architecture.

Product - Build & Features

ROI – A true N-tier Architecture and an integrated platform that provides an app and a browser experience and open source technologies , that lowering the overall TCO through for today’s being upgraded consumers. Automation – Standardised and simple process with high levels of Automation and enhanced efficiency

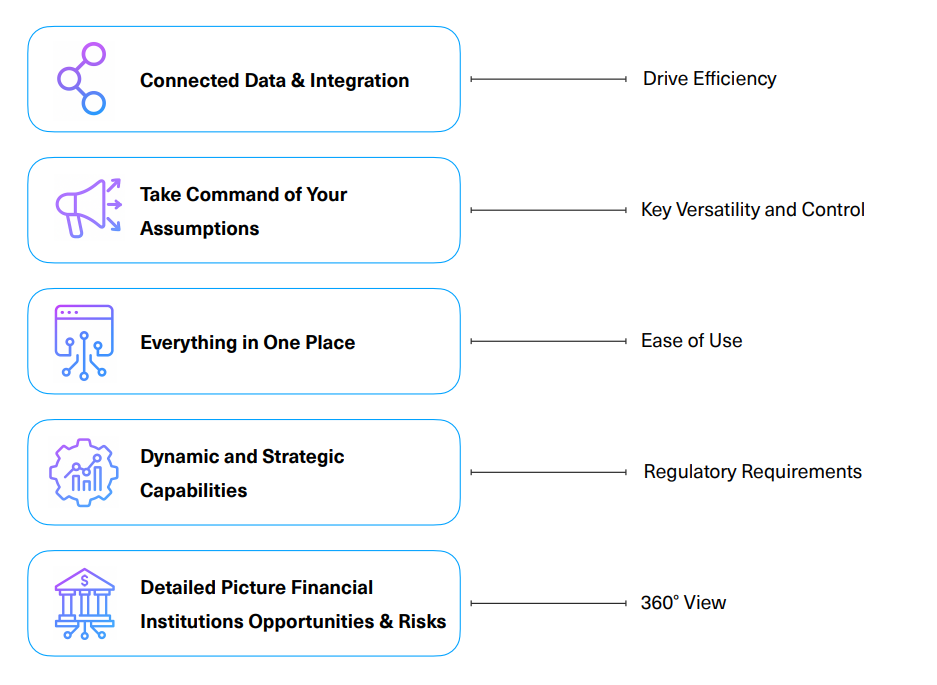

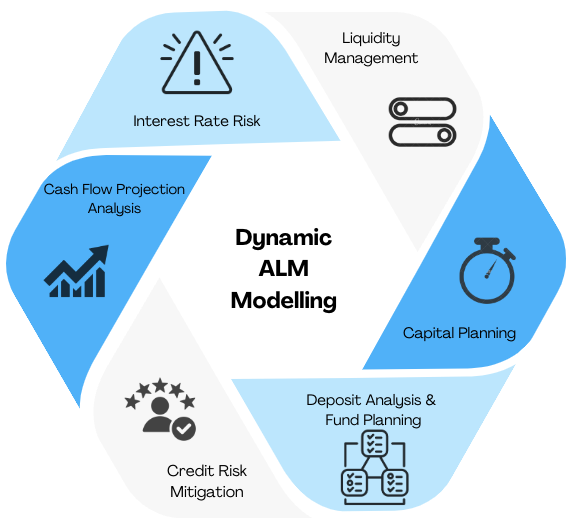

Asset Liability management (ALM)

Empowering informed decisions Make an informed decision by utilising our ALM comprehensive list of features

Empowers more than simply legal compliance Our ALM model enables customers to aggregate data from multiple solutions to create a unified view of their institutions opportunities and risks, while also making it simple to use and generate reports.

Our Asset Liability Management is an on-going process of formulating, implementing, monitoring, and revising strategies related to assets and liabilities in an attempt to achieve financial objectives for a given set of risk tolerances and constraints”. Asset and liability management (ALM) is a practice to mitigate financial risks resulting from a mismatch of assets and liabilities. We help financial institutions to manage liquidity, interest and currency risks within the regulatory and the bank’s own ALM limits, We help to ensure that the respective financial institutions to maintain sufficient capital buffers as per regulatory requirements. We are compliant with the RBI that had constituted a strong Management Formation System (MIS) for the NBFC & Co-op banks.

Our Focus

Run a more efficient, flexible, and digitally connected core banking system

Streamline business processes, automated back-office operations and improve profitability.

Achieve workload optimization, save time, making system more agile and equipped for work.

Intelligent processing capabilities with pre-integrated security and adaptive API monetization.